Determining Channel Distribution Curves to Improve Growth Outputs.

A PRACTICAL GUIDE FOR ALL LEVELS

😇

A PRACTICAL GUIDE FOR ALL LEVELS 😇

One of the most overlooked elements of Growth Marketing is the synergistic nature between your brand, your product, and your marketing channels.

Marketers fall into the “do everything, everywhere, all of the time” trap as they eagerly pursue new growth opportunities, high off their first dose of product market fit.

In reality, there will always be a power-law of distribution knowing that products and services are built to fit distribution channels, and not the other way around.

In his book, Zero To One, Peter Thiel explains the following:

“The kitchen sink approach doesn’t work. Most companies get zero distribution channels to work. If you get just one channel to work you have a great business. If you try for several but don’t nail one, you’re finished. Distribution follows the power law."

We often fall victim to the hubris of our brand, thinking that channels serve us.

This is a mistake.

Channels serve audiences — full stop.

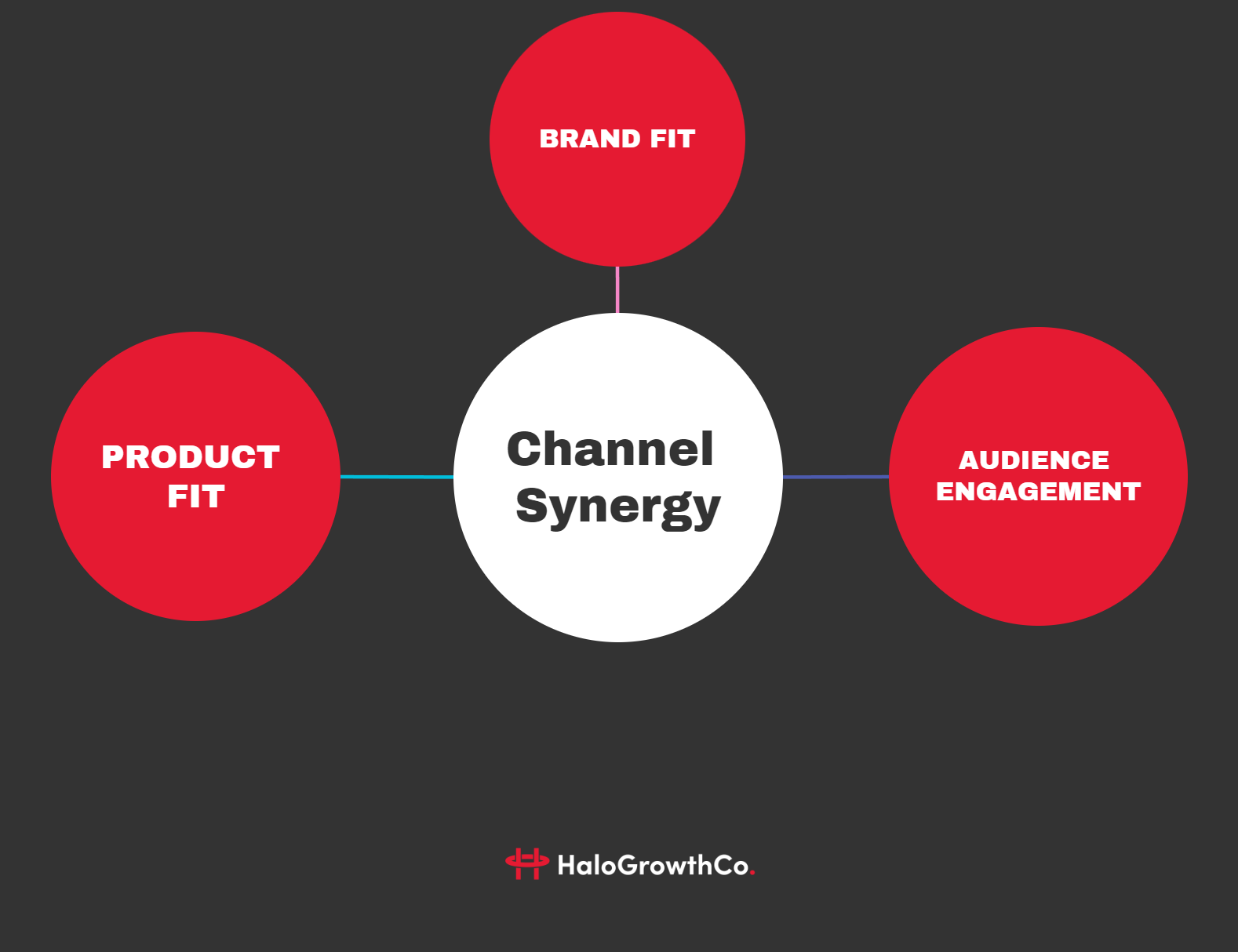

A high level overview of the inputs that create brand synergy.

Now, your brand might fit a high engagement audience, and your product might even be a direct response contender.

But keep in mind that direct response is dead for most brands. In order to drive an effective cross channel Halo effect you need not just a clickable ad and a high converting landing page.

You need brand, product, and channel synergy.

So how do you know when you have a fit?

Follow the guide below to find out.

First Step: Define Your Brand Identity & Core Product Value Proposition

If you haven’t done this already, and you’ve found market traction in excess of $1M+, you’re either operating in a niche market, or just lucky.

Defining a brand identity and core value proposition for your product is absolutely critical to your success.

In regards to establishing a brand identity, there are a few tools I can recommend.

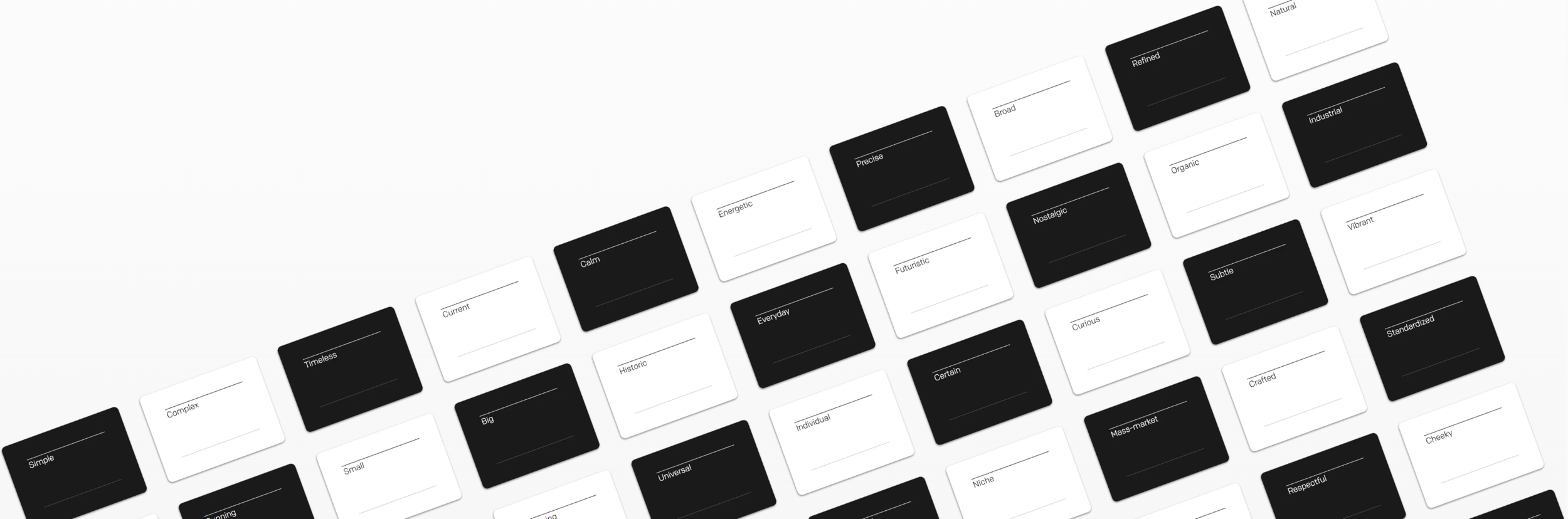

The first is brand deck — I have so much fun with these, and they are a great place to start.

source: https://branding.cards/

They will challenge you to articulate your brands identity in a fun card game. Word of advice: be as precise as possible. You don’t want to end up with a full stack of cards defining your brand. Do a few rounds if you can. The leaner and more focused you get, the easier the rest of this guide will be.

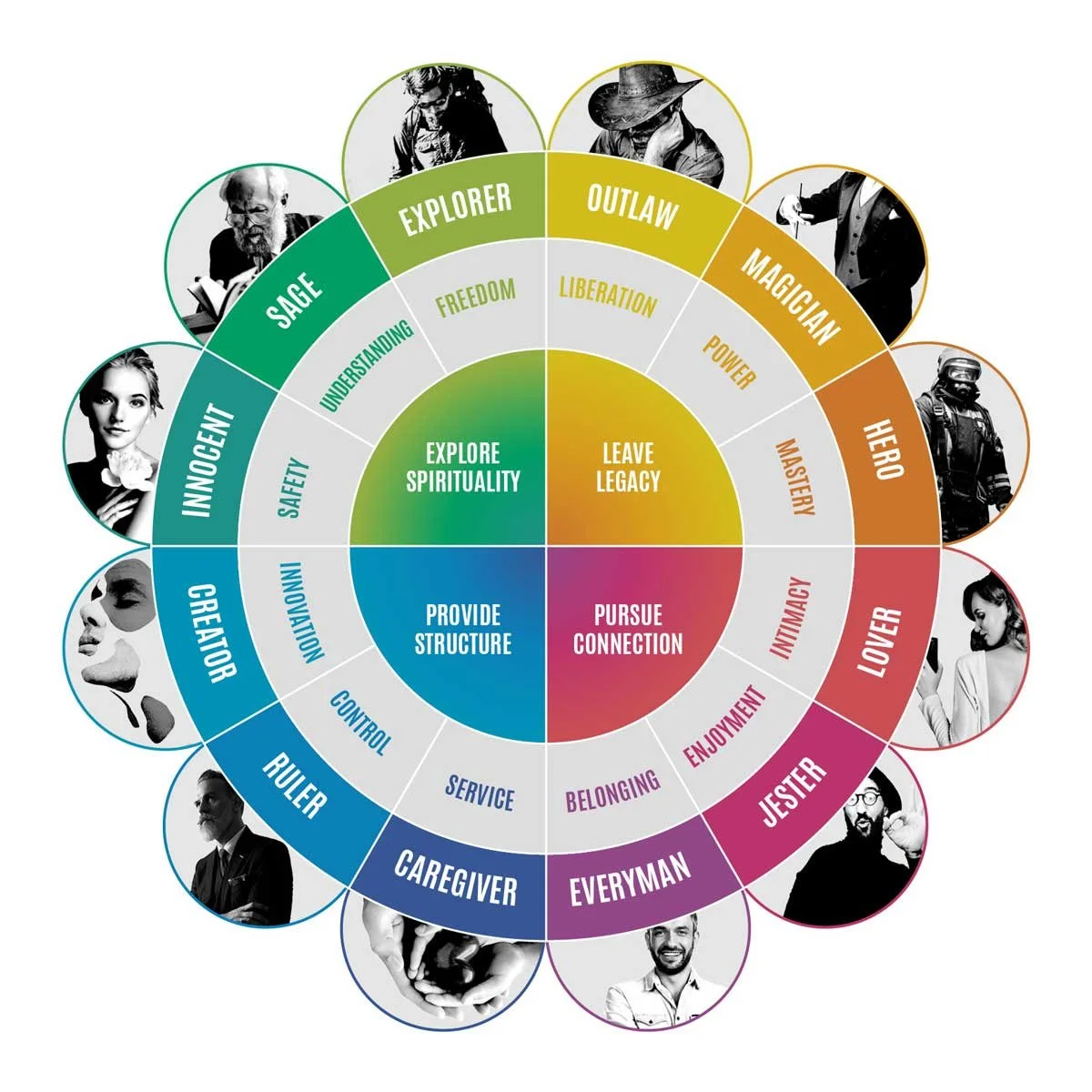

The great wheel of brand archetypes. Source: Iconic Fox

The next resource I like to leverage at this stage are Brand Archetypes.

These will really concentrate your brands essence and guide elements like voice, tone, and visual style.

Halo Growth Co., for example, is one part Hero and one part Jester.

These are not mutually exclusive, but I suggest limiting your archetype selections to two, maximum.

For myself, the Hero and Jester go hand in hand. This might comes as a surprise to you, but the mastery I have developed in my skillsets has provided confidence. That confidence, in turn, provides enjoyment.

That enjoyment, in turn, allows me to express a brand voice that can be as fun as it is serious. My personal brand therefore is direct yet light-hearted, engaging yet serious, and fun yet productive. It comes from a unique mix of my background, my experiences, and my skillsets.

Think about what this means for you and your brand, and then you can move onto positioning.

A template for a clear positioning statement. Source: Trew Marketing

To be clear, there is no particular order between positioning and brand identity. If you feel you have a clear picture of what value your product or service provides, you can always start here, and then let the implications of your positioning guide your brand identity.

For right brained marketers, it tends to be identity first, positioning second.

For left brains like myself, the inverse is true.

Generally speaking, a positioning statement is something you want to re-visit at least once a quarter. Products evolve, people evolve and customer needs evolve over time.

Here is an example of Halo Growth Co.’s positioning statement:

For [high growth start ups/scale ups] that care about [digital marketing, e-commerce optimization, retention, and product led growth], [Halo Growth Co.] is a [fractional head of growth as a service] that [provides guidance, support, and strategic management of growth marketing programs].

And now you can start to envision who your customers are, and on what channels they wish to discover such a service on.

But before we get ahead of ourselves and begin to match our broadcast our positioning statement on every channel, we need to develop further our customer personas.

Second Step: Define your Customer Personas

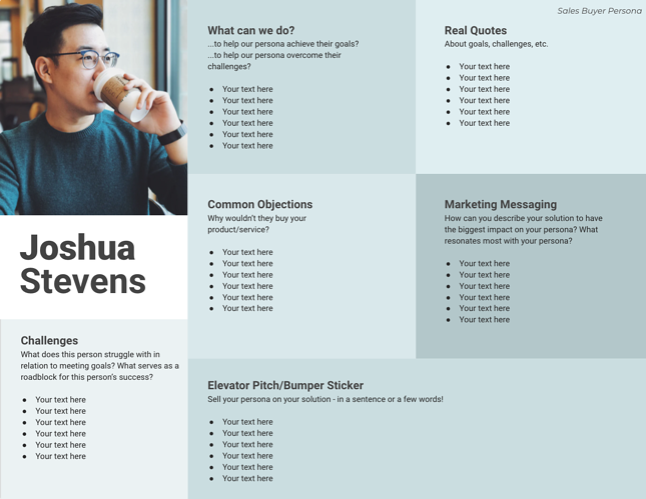

An example of a customer persona. Source: Hubspot

Unless you’ve been living under a rock in the marketing world, you’ve heard of customer personas. And my god, can marketing teams be lazy with this exercise.

They drum up a few key qualities of their ideal customer and call it a day.

As a growth marketer, even if you practice another discipline you need to go deep on this exercise, as it will guide everything you do.

At minimum, I recommend building at least three customer personas and two negative personas for a core product. If you have multiple products/services that deliver to very distinct audiences (i.e. male and female) you will want to develop another set for those.

To help you do this, I have created a very basic customer persona template. You may, however, wish to check out more templates and guides on this topic if you are a B2B org., have longer sales cycles and purchase decisions, or a more complex product. In such cases, I recommend adding user personas in addition to buyer personas, as often times the daily drivers of your software may be very different than the people who buy them (i.e. director or VP vs. manager or coordinator).

Once you have your personas developed, your brand vision created, and your product empowered with a strong positioning statement, you can begin to evaluate channels.

Third Step: Evaluate Your Channels

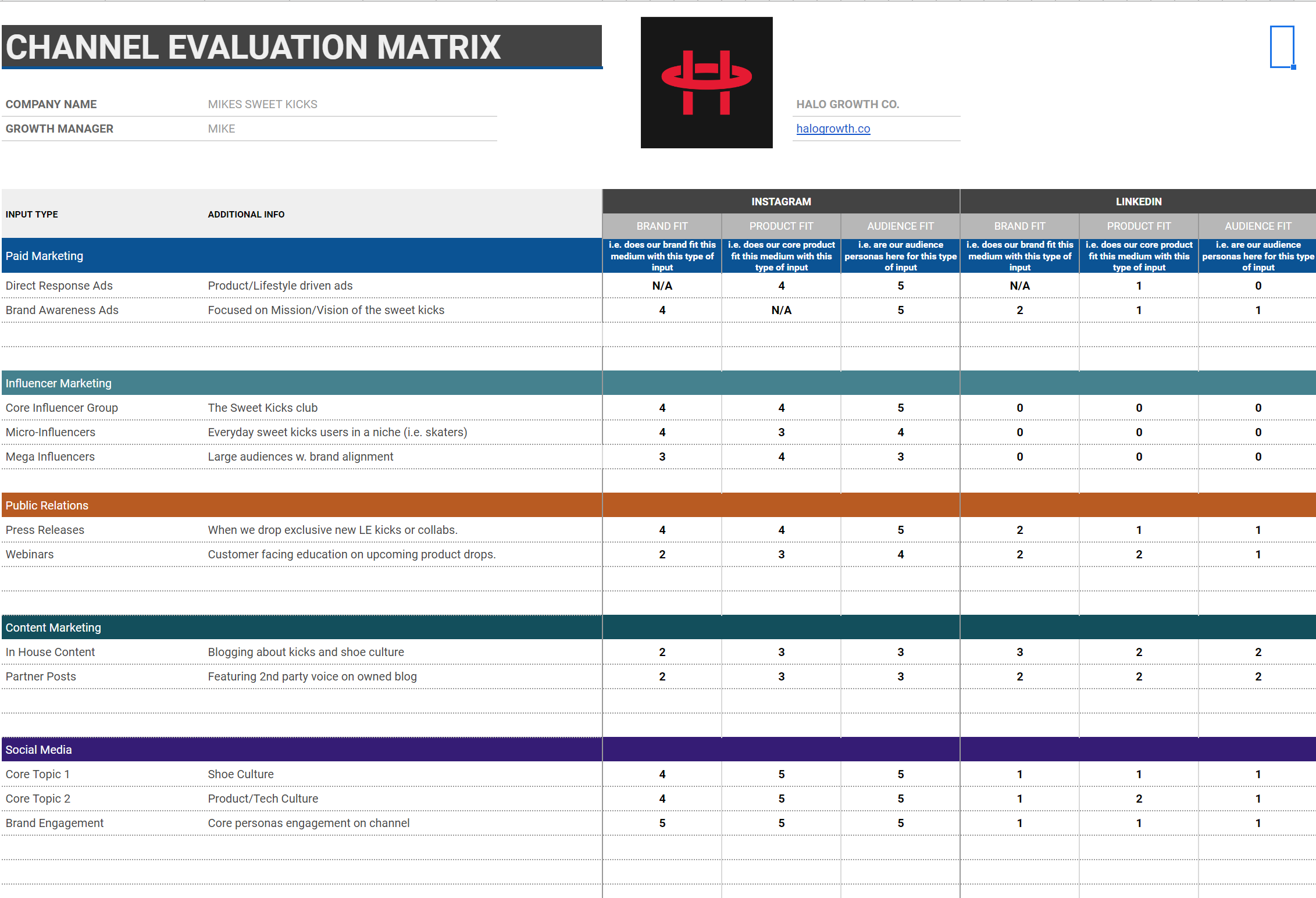

Channel Evaluation Matrix by Halo Growth Co.

To help you with this, I have created a simple Channel Evaluation Matrix.

Keep in mind, it is not necessary to evaluate every channel. Knowing now your product, brand and audience will help you narrow your focus to 4 or 5 key channels that you need to evaluate.

Nailing down your input types is essential, and here is where a basic growth model can help.

When you’ve created a high level map of HOW your product grows, you will understand the inputs require to pull the levers.

For D2C brands, I typically see the most impactful inputs being Paid Marketing, Social Media Marketing, Content Marketing and Influencer/Affiliate Marketing.

For B2B I see a healthy mix of Content, Events, PR, and Case Studies/Reviews.

Input types should be different for every organization. And not every input type will map directly to a brand, product, or audience fit. If my paid ads are product focused and have very little to do with brand preference (think: highly transactional or daily use products), then a brand fit is not applicable to that input type, on that channel. I also might simply not use that channel to spread a PR message, or a message about an event.

It is therefore natural for some channels to score higher via breadth of delivery vs. depth of fit.

I learned this while building Cold Brew Club.

Being a transactional daily use product, customers were far more interested in the product page featuring the flavor notes of the coffee vs. the brand story page. And that meant I needed to focus on product fit channels.

Once you’ve evaluated your channels, you should be able to output a basic channel distribution curve, which will likely follow the power law of distribution.

Keep this matrix on hand, as it will evolve over-time, be duplicated with additive product categories and audience expansions, and should be revisited at least once a quarter.

Once you’ve complete this, it’s time to move on to benchmarking execution.

Step 4 (Wrapping it Up): Benchmark and Measure Outputs

In case you haven’t notice yet, Growth Marketing is just as much an art as it is a science. Step 1 and 2 lean heavily into the art of branding, positioning and persona development. Step 3 and 4 lean a bit more heavily into the scientific aspects of growth.

When you’re finally ready to execute, measurement and observation are critical to your success.

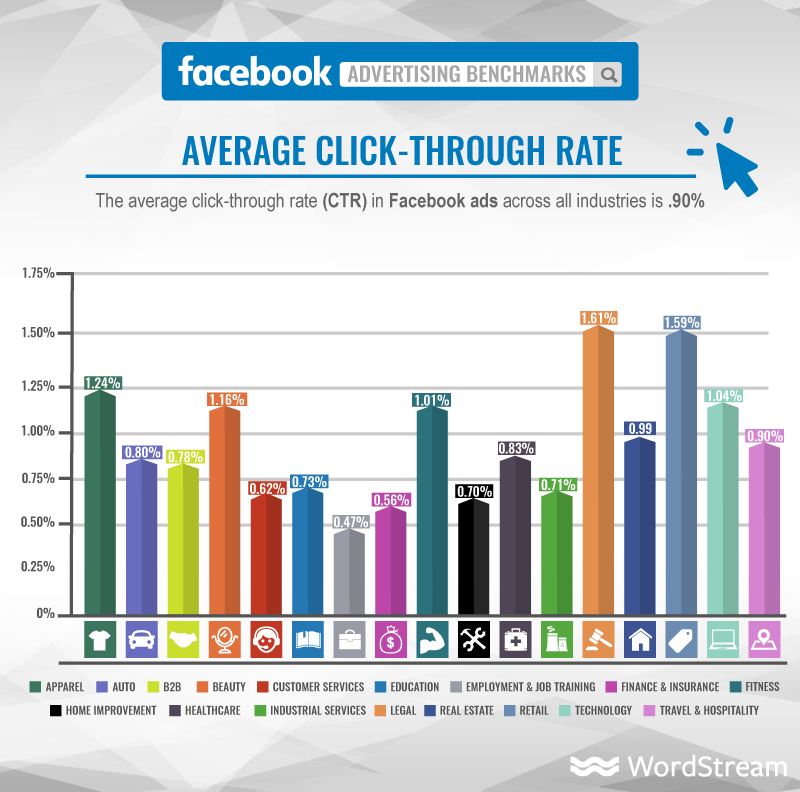

Industry Benchmarks for Facebook Ads Click-Through-Rates. Source: WordStream

When your channels are finally decided upon, I highly recommend collecting as many industry benchmarks as you can.

Talk to other growth marketers, media buyers, or whoever you can in your network. Find great data points and references, and constantly evaluate your channel synergies against whatever benchmarks are possible.

Your moto for the process of evaluation shall forever be “eternal vigilance”.

As mentioned above, audiences determine the rules of engagement on a channel, and audiences are fickle. Trends are made in an instant, and industries fall out of fashion quickly with only a few key missteps.

In this process, you will use both internal, and external data. Measure internally, benchmark externally.

For internal measurement you will want data points that match the natural buying frequency of your product. That is to say, the measurement cycles for a daily purchase like coffee will be much tighter than a more considered purchase like a new gold watch.

The next big consideration you will want to follow is experimentation.

For this, I will need to dedicate a whole new guide, perhaps even a series on experimentation.

But in the mean-time, I will leave you with a basic template to run in parallel to your benchmarking and evaluation cycles.

Just like your eternal vigilance towards evaluation, so should be your approach to experimentation, as learning are extremely valuable to any start-up/scale up business building from initial product-market fit.

As you graduate hypothesis you can either add inputs or channels as you scale.

A word of caution: adding channels can create multiplicative workload.

i.e. simply adding 1 channel and mirroring inputs creates X amount of inputs required to maintain/scale said channel.

You will not want to mirror inputs until you’ve found “fit” on at least a few key inputs types.

Conclusion

Thus concludes my guide on establishing your channel distribution curve and creating focus in your growth marketing efforts.

In my experience, this is absolutely critical for successful growth teams to maintain and evolve over time.

If one does not have a proper framework for prioritization, evaluation of channels, and experimentation driven by collaborative and iterative processes, you will quickly become lost in the great sea of digital marketing madness.

In addition, adding in new channels, new audiences, new markets, or pursuing the latest trends just for the sake of vanity laden brand optics will create multiplicative workload.

Meaning all inputs are multiplied over to X channels or X market or X audience.

Inputs can be simply additive if tailored to fit the right channels and efforts.

Adding channels, markets, or product categories tends to be multiplicative in nature, and that can quickly burn out your team.

Stick to the right frameworks, manage expectations upward if necessary, and keep your growth efforts laser focused.